6. What you need to Realize about Jumbo Fund

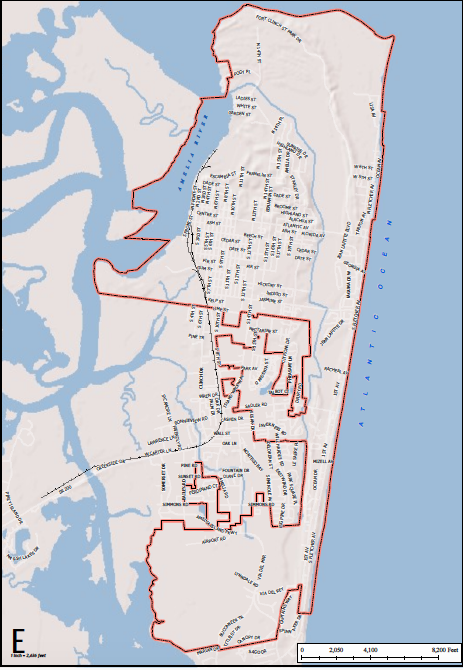

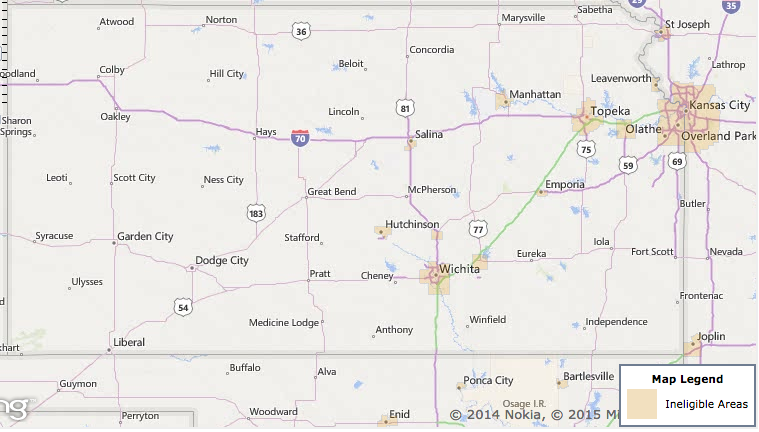

This new U.S. Company regarding Farming backs the USDA program while offering financing in order to low-to reasonable-money buyers. These financing could only be reproduced so you’re able to home within the being qualified USDA-zoned properties when you look at the rural section.

This could be advisable having customers shopping for life of urban and residential district parts. Loan providers require at least credit score regarding 640 to use this particular financing.

Jumbo loans is larger than almost every other funds. Since 2024, in most segments, one loan one to is higher than $766,550 is more than this new compliant number limitations lay of the Federal national mortgage association and you can Freddie Mac computer.

By the larger number and dangers of the they, the minimum borrowing amount is determined from the 700 or maybe more, with regards to the bank you use.

7. Other variables Determining For folks who Be eligible for A home loan

Even if most lenders weigh greatly towards an excellent borrower’s credit history, it is vital to comprehend the over picture together with active lenders used to dictate the healthiness of debt affairs.

Loan providers have a tendency to examine your income because the a major deciding reason for introduction towards the credit rating prior to obtaining a home loan. This means that, your own month-to-month money will act as the new baseline for everyone out-of one other products.

Lenders will likely be certain that the work of the conversing with your employers and requesting bank statements, tax statements, and pay stubs to ensure your earnings. After fully verified, your own lender use that it number to go to the next portion, which is your financial situation and you will expenses.

Pertaining to your income, a unique component that lenders will want to guarantee with your manager can be your stage in your job. Most loan providers want to see borrowers in identical host to employment for at least two years or when you look at the same profession of work with at least 2 yrs. Criteria about portion differ based on and therefore lender youre playing with.

8. Obligations To help you Earnings Ratio

When your lender has generated your revenue and you may verified your a career, they will almost certainly initiate asking having papers into one recurring debts. This consists of credit cards, figuratively speaking, alimony otherwise child assistance, and you may automobile payments.

Immediately after this type of expenses was indeed computed, the lending company would want to is an estimated month-to-month mortgage payment. On month-to-month mortgage payments and all of recurring expense, they do not want it total exceed 50% of one’s overall monthly earnings. In the event it cannot be finished, you’re likely to perhaps not be eligible for financing.

This little bit of the borrowed funds puzzle can easily be enhanced in the event that required, so be sure to consult with their financial regarding borrowing from the bank fix programs. Sometimes, such monthly repeating bills will be improved by the protecting upwards certain more funds and you may repaying several of your financial situation.

nine. Discounts

The level of cash put aside a borrower have access to directly impacts the capability to obtain an interest rate. It dollars reserve is sometimes put because protection to have a great lender in the event the a top down-payment becomes necessary.

If you are buying a property in the near future, you will want to remember to have enough saved into the reserves to suit your deposit and to assistance with your overall closing costs. Deals can also be offset people amounts when you are less than package.

Its normal to execute checks, and you will following checks, you are going to gauge the all about home inspections along with your leading a residential property agent to see exactly what negotiations and you can solutions was requisite.

In the event your vendors do not agree to build these requisite repairs, Castle Pines Village Colorado payday loan reviews you need some funds from your savings to do them your self.

Remember, North carolina are a keen “As-Is” state, called an excellent Caveat Emptor condition, that translation setting “Buyer Beware.” In Vermont, house are sold “As-Are,” and you may sellers are not required to make any solutions to have a good customer.