An identical is often said for vehicle name financing, payday loans, no-credit-consider financing, and you can payday loan

- A broke but high-possible pupil just who requires the additional fund to invest in good brief go on to yet another venue where they could possibly rating a beneficial prestigious employment and you may instantaneously become a premier earner to invest off of the loan.

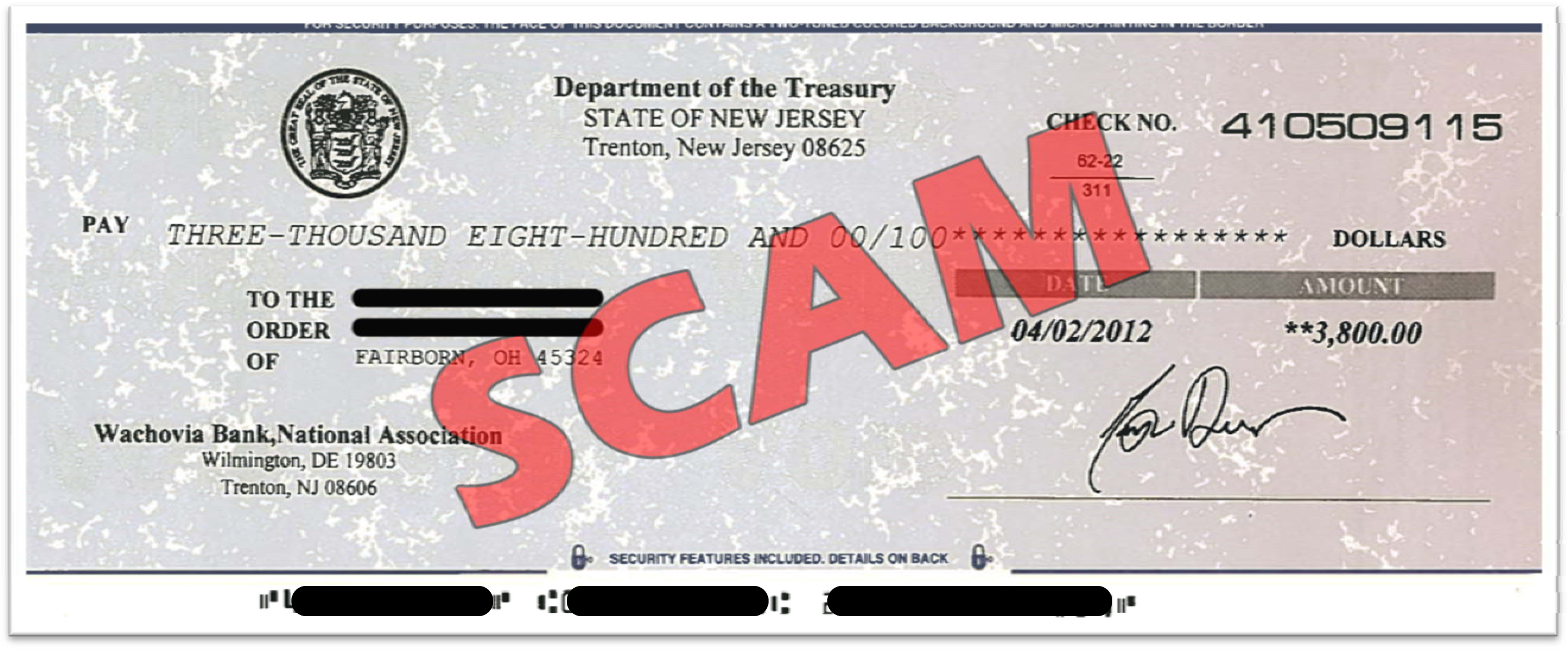

Sadly, deceptive or predatory lenders manage occur. Firstly, it is uncommon for a lender to increase an offer in place of very first requesting credit score, and you may a lender doing this could be a revealing indication so you’re able to avoid them. Money advertised thanks to bodily send otherwise because of the cellular telephone has a premier threat of becoming predatory. Essentially, this type of fund have quite high rates of interest, excessive costs, and incredibly quick pay terms.

Personal loans and you may Creditworthiness

Brand new creditworthiness of an individual is amongst the fundamental deciding grounds impacting brand new grant out of a consumer loan. A great otherwise advanced level fico scores are important, specially when trying signature loans at the a good rates. Individuals with all the way down fico scores will find partners solutions whenever trying a loan, and finance they might secure usually feature bad cost. Such as for instance credit cards and other financing signed that have a lender, defaulting to your unsecured loans can harm somebody’s credit rating. Loan providers that look beyond credit ratings perform are present; they normally use other factors eg debt-to-money percentages, stable a position background, etc.

Personal bank loan App

The applying procedure is visit the site oftentimes very easy. To apply, the lenders generally speaking ask for some elementary suggestions, and additionally personal, employment, income, and you will credit history recommendations, certainly a number of other things. This particular article will most likely are from documents instance income taxation statements, latest spend stubs, W-2 versions, otherwise an individual statement of finance. Many loan providers now create borrowers to submit applications on the internet. After submitting, information is assessed and you will confirmed by bank. Some lenders choose instantaneously, while some usually takes a few days or months. Applicants can either end up being approved, denied, or accepted having requirements. Regarding the latter, the lending company only provide when the specific requirements are satisfied, including submitting even more pay stubs otherwise files pertaining to possessions otherwise debts.

When the accepted, unsecured loans will likely be financed as fast as within 24 hours, making them quite useful when cash is required quickly. They have to arrive just like the a lump sum during the a bank account given in the initially software, as numerous loan providers need a free account to transmit personal bank loan financing through head deposit. Certain lenders is also send inspections otherwise weight currency with the prepaid service debit cards. When using the mortgage money, make sure you stay inside courtroom boundaries because the denoted regarding the bargain.

Consumer loan Costs

Besides the typical dominating and you may attention money generated to your people sorts of loan, for personal money, there are charges for taking notice away from.

- Origination payment-Often called an application fee, it helps to fund costs associated with handling apps. It generally speaking selections from one% in order to 5% of amount borrowed. Certain lenders request the fresh origination fee upfront while most deduct the cost just after acceptance. As an instance, $ten,000 lent that have an effective 3% origination fee will internet $9,700 towards borrower (new repayment has been centered on $10,000, however).

- Prepayment commission-that it fee is appropriate whenever a debtor pays the personal loan otherwise produces payments just before agenda. Signature loans that features prepayment charges are less frequent now.

- Late percentage percentage-Lenders may charge a charge for using too late. Avoid it simply by expenses all of the fees timely. It helps to make contact with lenders ahead if the a great percentage cannot be generated towards the a deadline, due to the fact some are ready to offer due dates. That it commission shall be apartment or reviewed since a percentage regarding the new payment, with respect to the financial.