Certain education loan forgiveness is here what does that mean to you personally?

The newest pandemic has taken unique challenges for younger years – virtual school graduations, terminated spring season vacation trips, delayed weddings, and you will a quickly altering job market. Even with these types of setbacks, you’ve got seen a little move space in your finances getting such things as Ravens game otherwise a long weekend along the ocean. That is because, for the past a couple of years, government entities paused education loan costs to include Americans specific economic rescue.

The student loan percentage stop might have been prolonged one last time to help you . Together with one finally expansion, certain individuals will get located to $20,000 during the education loan forgiveness. With your changes, you’re curious, exactly how much loans forgiveness are you willing to be eligible for? Because the a Maryland resident, just how much do you ever have to pay? Should you decide start budgeting?

For those who have education loan financial obligation, we are able to help you create feeling of your options just before college student loan cost resumes.

Who’s entitled to education loan forgiveness?

You may possibly have currently been aware of the brand new Student loan Loans Package and seen a good amount of consider bits about the impact of student loan forgiveness to your cost savings, inflation and you may individuals who possess already paid its expenses. However, we are really not here to inform you whatever you think of student loan forgiveness. Our company is only here giving information what you should do for the white of them the new improvements.

- Simply somebody getting less than $125,000 a-year are eligible

- Individuals whom gotten Pell Offers will get $20,000 inside forgiveness

- Consumers rather than Pell Gives will get $10,000 inside forgiveness

That’s not the sole assistance outlined within new package. The program and additionally tries to make payments way more manageable to possess individuals. Regardless if you’re not entitled to $20,000 inside education loan forgiveness, you may still benefit from the bundle.

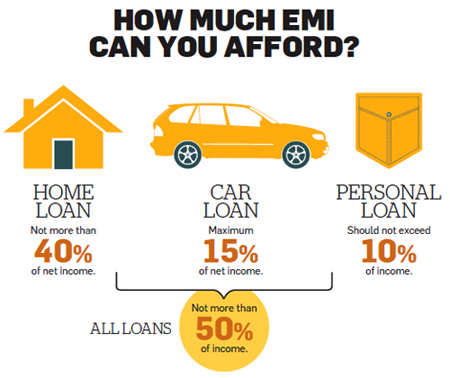

- Cap payments on 5% of your own month-to-month earnings – off out of 10%

- Improve what’s thought non-discretionary income to support lower-earnings professionals

- Forgive balance out of $several,000 or reduced immediately following a decade – down off 20 years

- Shelter delinquent www.paydayloansconnecticut.com/mashantucket/ attract, very borrowers balances dont develop

New effect out of scholar financial obligation inside the Maryland

When the education loan costs resume, Millennials and you may Gen Zers inside Maryland have a tendency to feel the influences even more intensely than in other state in the united states. That’s because the common Maryland borrower recently less than $forty,000 inside education loan financial obligation according to Student loan Champion. In fact, Arizona, D.C. is the just set with an increase of education loan loans than simply Maryland.

Rising cost of living tend to impression rates of interest

Earliest, your property manager raised the rent. After that, fuel costs increased. Today, their normal stop by at the fresh supermarket seems to get more expensive every week. Whether it appears like your own salary is evaporating reduced than in the past, they probably is actually. And inflation should be to fault.

You have likely read that rising prices is actually driving a sudden boost in rates of interest towards the mortgage brokers. That can also be one of the reasons you don’t getting prepared to get a property but really. Exactly what create these actually-changing rates have to do with your student loans? About student loan cost pause, borrowers have not must love interest levels at all because the the new stop as well as provided 0% notice.

Already, rates of interest towards brand new figuratively speaking stand just below 5%. Having Marylanders holding way more debt than just borrowers in other states, ascending rates you can expect to strike your more complicated. If the education loan cost pause end, you may find oneself struggling to lower obligations smaller than they accrues attract.

Don’t embark on a paying spree at this time…

As with any biggest bit of legislation, education loan forgiveness has plenty of competitors. You’ll they affect the future of the fresh Education loan Debt Package? Of several competitors of one’s choice argue that presidents don’t have the ability to offer education loan forgiveness.

Because of this, you are able the master plan you could end up a court case over if the choice holds true. If it would be to happens, consumers would likely be left at night before case was compensated. Perhaps the conclusion will end up into the courtroom is still upwards floating around. And you may what would occurs next if your decision was to be hit off is also more unclear.

So what can you do in the meantime? Stay apprehensive about their using and also make the desired repayments whenever it get back within the 2023.

Find out how far you borrowed from incase

In the SECU, we make it easy for you to plan your next payment. When your student loan repayment pause concludes, we’ll publish an alerts by post in addition to all you need to find out about the fee plan as well as how much you’ll are obligated to pay.

Undecided you could undertake such costs once again along with your most recent funds? Seek suggestions owing to our totally free financial fitness check-ups. All of our highly trained counselors will work with you to know their book problem and offer assistance on how best to manage your cash.

Update your contact information

Usually do not exposure forgotten people important reputation about your education loan payments. Log in to the SECU account to ensure we possess the best emailing target and you can contact number.

Look for student loan support with SECU

We are right here to own everything you you would likeas well as a far greater rates on the student loans. When refinancing the figuratively speaking due to SECU, you could slow down the quantity of expense you only pay while also securing a cheaper payment per month.

Refinancing could even change your odds of protecting fund some other biggest assets such as a new auto or a mortgage, getting you one-step closer to repaying their college student obligations and achieving essential post-graduate goals. Learn more about how SECU makes it much simpler about how to pay-off the college loans.