Exactly how much mortgage must i be eligible for?

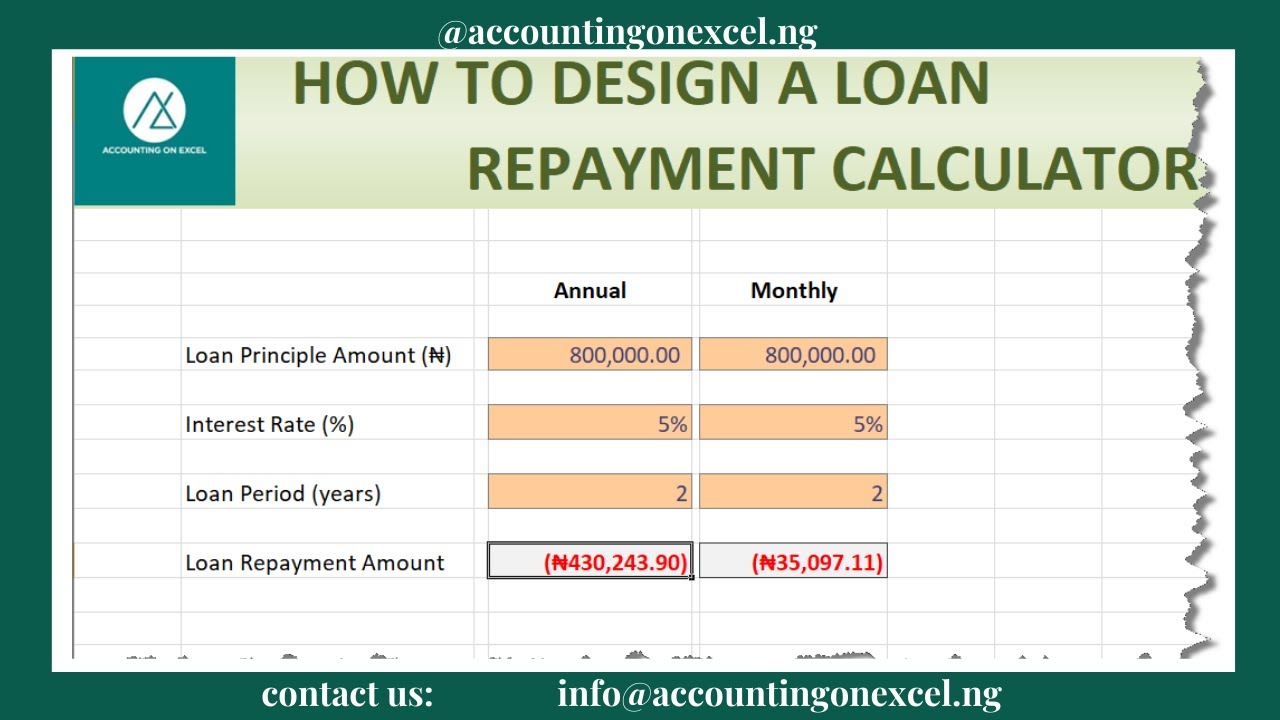

Illustration: check out the desk less than to know just how additional things dictate the newest eligibility to help you avail of a mortgage:

- Age conditions: Your actual age is the better determinant sensed because of the financial institutions when you are choosing your house financing qualification. Really financial institutions limit the home loan tenure on the applicant’s retirement ages. Therefore, when compared to younger someone, it is sometimes complicated to have seniors nearing retirement to find an effective longer-name financial except if he’s got evidence of a frequent income source.

- CIBIL or credit rating: Their CIBIL or credit history is an additional essential determinant according to that your bank assesses your loan fees feature. The financing get is a three-digit number which is fundamentally a summary of your credit score. It will always be a good option to evaluate minimal borrowing get having a mortgage before checking your home mortgage qualification because the a poor payday loans without bank account in Pennington credit get contributes to highest rates of interest otherwise financing rejection.

- Income balance: The main cause of cash and employment balances having salaried everyone is taken into consideration because of the loan providers whenever approving applications. Similarly, self-operating somebody are going to be qualified to receive financing whenever they show he’s a reliable source of income. Let us understand this which have an illustration.

Illustration: take a look at dining table below to understand exactly how various other things influence the fresh new qualifications to acquire a home loan:

- Possessions details: The age (time or even the year away from framework) and the location of the possessions you’ve selected to purchase are among the severe factors one financial institutions could possibly get believe while granting your property mortgage. These issues try to be a sureity against which you are able to get the house mortgage. Moreover, there is a spin that the mortgage application do score refuted, in case your period are more than the rest preserving several years of the house or property. Ergo, banks always make a type of technology and you will judge data away from the property ahead of sanctioning the house financing.

- Loan-to-really worth (LTV): The mortgage-to-value ratio otherwise LTV home based loan is the proportion involving the mortgage number and also the appraised worth of the latest property. Inside simple words its one of many chance assessments gadgets or strategies used by financial institutions to minimize the likelihood of defaults. It is essentially the part of the home well worth one to a great bank is also provide to help you a home consumer.

- Debt-to-earnings proportion: Debt-to-earnings proportion means an evaluation product sensed from the finance companies to measure the house financing applicant’s fees capability. It is determined while the a percentage by splitting our home mortgage applicant’s online monthly personal debt costs because of the their unique monthly earnings.

To buy a home try a dream of numerous hope to, however the fear of monetary setbacks can also be overshadow the fresh thrill. Particularly concerns are all. That is where our home loan eligibility calculator will get essential.

This guide delves deep towards electricity of the product, taking information to help you avoid monetary issues, and you can reassuringly flow nearer to having your perfect domestic.

Addition so you can Home loan Qualification

To shop for property the most tall financial decisions an individual can build inside their lifetime. For most people, you cannot pick property downright, for this reason of numerous check out lenders otherwise mortgages.

First the excursion into the homeownership, it is necessary to comprehend the thought of mortgage qualifications. It will not only determine if you can buy a loan and also simply how much you could potentially obtain.

Financial qualification refers to the standards and conditions predicated on and that a lender determines if a single qualifies to own a mortgage. It is a means to have loan providers to evaluate the chance of financing currency to help you a debtor.