Exactly why is it best if you prepay your home Financing?

Mortgage brokers have made it possible for the majority of people in order to realize their imagine home ownership. While offered tenure finance was desirable to of numerous because EMIs try manageable, of many together with be cautious about a method to clean out or pay back the debts. Financial prepayment is the one particularly means that will help you reach that goal and certainly will be considered a good clear idea on longer term.

It assists it will save you towards focus cost

Lenders are significant expenses that have a large piece because the attract. Once you prepay your financing till the end of one’s tenure, it will save you substantially.

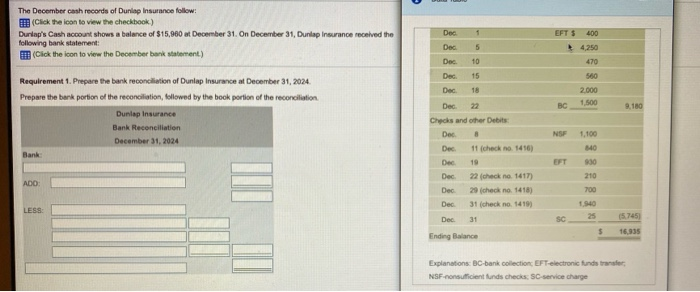

Look at this amortisation agenda to have a mortgage away from ?ten lakh on an interest rate of 8% p.good. to possess a tenure away from 8 years.

In the above analogy, the complete interest matter from the financing period away from 8 years is ?3.57 lakh. For individuals who prepay the loan at the beginning of the fresh period, you can save a great deal for the desire cost. Together with, the attention prices protected are often used to complete other lifestyle specifications particularly finance for your baby’s knowledge, advancing years thought, etc.

Alter your credit score

Paying off the loans through to the avoid of the tenure manage suggest your own borrowing from the bank incorporate proportion falls. Down borrowing from the bank utilisation have a positive impact on your credit history, and your full credit rating improves. We realize one to credit scores rely extensively on your own capacity to pay off your financing. If you are timely repayments are good for keeping a robust credit history, prepayment is an excellent solution to make also maintain good credit.

Improve your likelihood of choosing other finance without difficulty

![]()

As stated earlier, prepayment of your property Loan facilitate replace your credit history. Which have a far greater credit history, your odds of choosing off other money, such as for instance auto loan, business mortgage, degree financing, etc., expands.

Avoid payment defaults

For many who pay their part of the financing early, it may help it will save you out-of fees non-payments occurring however, if out of emergency otherwise difficult activities. You positively don’t know exactly what the future retains for your requirements, but it does sound right to repay the fresh new portion of your residence Loan immediately (for those who have finance) to cease any monetary hiccups later on.

What things to bear in mind before prepaying your house Financing

While the we have examined some great benefits of prepaying Lenders, check out issues need certainly to believe before you take this step.

- Determine your existing https://cashadvanceamerica.net/payday-loans-oh/ and future economic demands.

- Just be sure to keeps an acceptable crisis funds in order to meet people unforeseen expenditures.

- Verify that you will find people prepayment lock-when you look at the period.

- Look for any prepayment penalty. Normally, Lenders that are taken on fixed rates charge a prepayment punishment.

- For folks who pay-off your house Financing very early, you might not get the taxation deduction. Examine the way it make a difference to your current taxes just before this.

Achievement

Prepayment of Lenders best suits those with free or most funds. Using this, you might reduce your credit load, improve your credit history and construct fund having very important economic specifications. At the Axis Lender, we realize the challenges off controlling a mortgage, therefore we try right here so you’re able to every step of way. Our house Financing include versatile EMI solutions, competitive interest levels, and you will a range of other features that make your home to find experience difficulty-totally free.

Disclaimer: This information is to possess advice purpose merely. Brand new viewpoints conveyed on this page was private and don’t necessarily create brand new opinions away from Axis Bank Ltd. and its own team. Axis Bank Ltd. and/or the blogger will not be accountable for any head / secondary losings otherwise responsibility incurred by the reader when planning on taking one monetary conclusion based on the contents and you may guidance. Excite speak to your financial coach prior to one monetary choice