Go back home Funds for buying, strengthening, remodeling, fixing, or designing your dream living area

Have confidence in the newest range Mortgage brokers provided by HDFC Lender to order or build your fantasy house. You may also decide to transfer your existing Financial away from another bank out over me to make use of our loan also provides.

In the HDFC Bank, you can enjoy attractive Mortgage rates of interest also an effective hassle-100 % free loan application process, effortless mortgage cost choices, and versatile tenures. We provide various Home loans, plus Greatest Right up Funds, Do it yourself Financing, and you can Household Extension Financing.

Benefit from the convenience of applying for financing on the internet with the help of our user friendly electronic app process. Of course, if you prefer a little bit of guidance in the act, i supply qualified advice and prompt support service for everybody their Property Financing question.

- Glamorous Interest levels

- Seamless Electronic Software Procedure

- Most Topup of Upto ?50 lacs*

- Special Processing Costs having Government Team

- Easy & Easy Electronic App Processes

- Zero hidden charge

- Designed installment options to meet your requirements

- Maximum Finest Upwards Financing regarding ?50 lacs*

- Money to possess current users

- Attractive Interest rates???????

Home financing is a kind of financing that one can get for purchasing a ready-made assets, building your own home, or remodeling/stretching your current assets. You may want to manage an equilibrium Import of your own established household loan out to a unique bank instance HDFC Bank to have finest Mortgage interest levels.

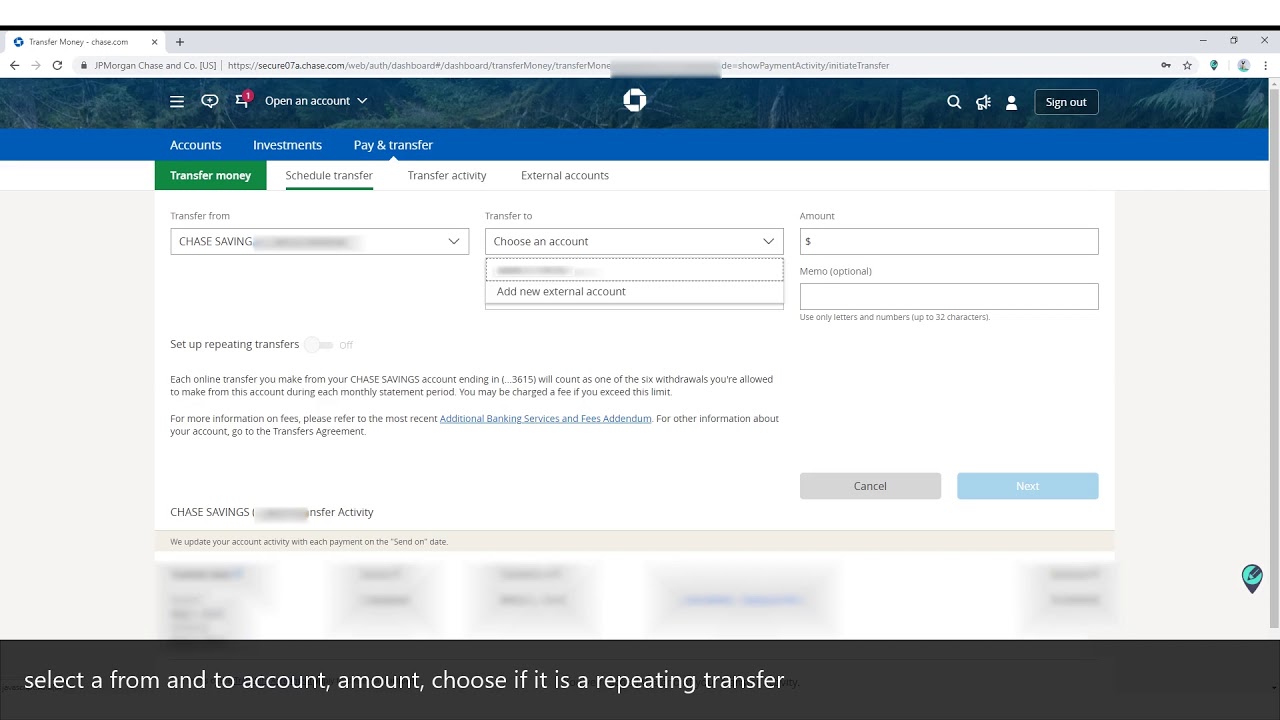

Pertain Mortgage Online

At the HDFC Financial, you’ll sign up for a mortgage online. Our webpages are member-amicable and can intuitively show you through the processes. You could check us out at your nearby HDFC Financial part.

When you get home financing, you can get 75 so you’re able to 90% of your own full possessions prices. Furthermore, in the event the Mortgage is actually for structure, home improvement or expansion, upcoming 75 to 90% of construction/improvement/expansion estimate should be financed. The remaining 10-25%, according to loan amount, can be your own contribution.

Yes, according to the Income tax Act, 1961, you could take advantage of some income tax professionals by paying home financing. Area 80C makes you take advantage of an effective deduction from Rs step one.5 lakh toward principal matter installment. Depending on Part 24, you could allege deductions doing Rs dos lakh on notice costs. Area 80EE will bring most taxation benefits for first-time homebuyers. All of Colorado title loan near me these tax-protecting conditions can be applied predicated on specific conditions and terms given that laid down because of the Act.

The qualifications having a home loan largely hinges on items such as as your income and you can installment capacity. Apart from that, most other decisive items is your actual age, degree, spousal income, quantity of dependents, property and liabilities, offers history, and balance out of community, yet others.???????

Terminology & Standards

One Small print (MITC) of your financing within Borrower/s – and you will Houses Innovation Loans Firm Limited, a family provided according to the Organizations Work, 1956 and having their joined workplace during the Ramon Family, H T Parekh ation, Churchgate, Mumbai 400 020, hereinafter called “HDFC” are decideded upon and you can mentioned once the significantly less than:

(i) Variety of :(ii) Attract chargeable :(iii) Moratorium or subsidy :(iv) Big date from reset of great interest :(v) Settings off interaction of alterations in Interest rate : HDFC informs of such improvement in Merchandising Prime Credit Rates (RPLR) thanks to good ‘press release’ inside big top news documents round the India as well as on its webpages hdfc.

(a) The level of EMI :(b) Final number regarding installments where the loan is repayable inside equated monthly payments :

*Susceptible to type with regards to the mortgage arrangement done/ become conducted amongst the Borrower/s and you can HDFC. HDFC shall try to remain its Consumers told of any changes in the rates with the officialwebsite (hdfc), annual statement regarding levels, display within its organizations and general announcements fromtime to day. When the such as for instance alter is to try to new disadvantage of your own customer, he/she could possibly get within this 60 days and you may without warning romantic their / their unique account otherwise turn it without paying any additional costs otherwise appeal.