How-to Apply for an excellent USDA Loan inside Florida

USDA Rural Development Loans offer Florida residents the ability to individual a home no down payment having the lowest repaired notice rate.

What’s a USDA Mortgage?

An excellent USDA loan is actually a zero-off lending services supported by the newest U.S. Service away from Agriculture. Lined up priilies, USDA funds make homeownership attainable for these remaining in or relocating so you’re able to rural aspects of The united states.

These types of funds, an element of the USDA Outlying Advancement Protected Housing Financing system, is great for prospective residents with limited funds. As opposed to Fl traditional money, which will demand the absolute minimum deposit out-of 20%, USDA funds don’t need people upfront currency.

While you are there is no advance payment, homeowners are nevertheless guilty of closing costs plus guarantee charges. Consider a guarantee fee due to the fact the same as private financial insurance coverage you to shelter the lending company in case there is financing default. This new upfront ensure fee is typically 1% of amount borrowed, due to the fact yearly costs hover as much as 0.35% of the loan amount.

Most recent Fl USDA Home loan Cost

The mortgage pricing showed on this site is actually having educational purposes only and tend to be at the mercy of changes anytime with no warning. Prices can vary according to various affairs, as well as not simply for, the creditworthiness, the mortgage-to-worthy of proportion, and you can current market requirements. This new showed cost do not make up a partnership so you can give. To locate an accurate or more-to-time financial rate estimate, excite get in touch with This new Wendy Thompson Financing Team privately. All of us out of financial professionals offers personalized prices and you can conditions considering your unique finances and you may loan standards.

Florida USDA Financing Qualifications

Become eligible for an effective USDA financing during the Florida involves fulfilling certain personal, possessions, and you can income standards. Private qualifications mostly entails becoming good U.S citizen, a low-citizen national, or a qualified alien. At the same time, applicants should be at the very least 18 yrs old and legitimately capable of accepting the borrowed funds obligations.

- The house you wish to pick personal loan companies Chicago IL are during the a location that’s thought eligible of the USDA. Which constantly discusses outlying regions and many suburban zones.

- Your income ought not to discuss the money limit in for your unique county and you may state by the USDA.

- A stable and you may trustworthy income is a must. It money can be ample to fund your monthly mortgage payments, most other expenses, and you will bills.

USDA Loan Conditions Into the Fl

Becoming qualified to receive a good USDA loan into the Florida is part of visualize. To completely be considered, there are many conditions you should conform to:

Credit rating : The very least credit rating is given by USDA mortgage brokers, no matter if lenders might inquire about increased credit history compared to the USDA importance of financing approval.

Secure Income : An important factor believed will be your ability to build uniform monthly costs. One indication of secure money over two years might be of good use.

Fee History : The record of fast payments for rent otherwise past mortgage loans more than the past one year can be rather apply at the loan approval opportunity.

DTI Percentages : Loan providers observe the debt-to-Earnings (DTI) proportion, which is the portion of gross month-to-month money utilized for month-to-month financial obligation payments. The latest USDA states a couple of percentages. The first is 29% getting property-related personal debt, while the 2nd try 41% to have total debt.

The applying techniques getting a great USDA financing is comparable to help you planting a lime forest from inside the a florida grove towards the best steps, you can get a booming lead. Here is how you do it:

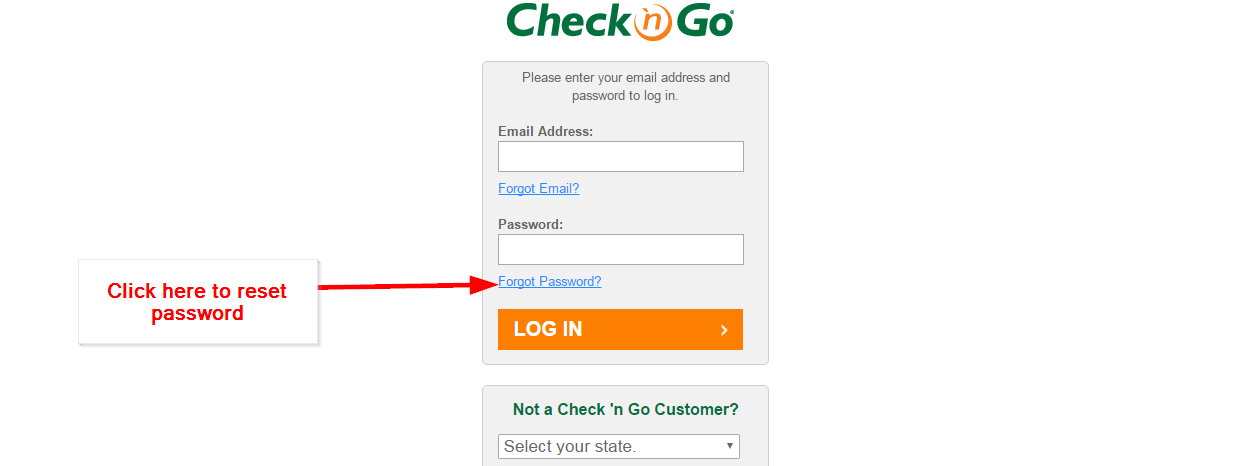

Meet with a lender : An effective USDA-approved lender can make suggestions from the procedure, letting you know what you may anticipate and the ways to bundle accordingly.