This program was designed to provide reduced-desire fees funds to help you people who own qualified residential local rental houses citywide

Home improvement Software

Our home Improve Programs help homeowners and landlords in the Wichita that have critical home repairs so you can established structures in order to maintain secure, suit and you may sensible housing solutions from inside the Wichita to benefit lower and average money properties.

Candidates must individual your house, are now living in the house, feel latest towards possessions taxation, keeps homeowner’s insurance rates and then have a qualifying income are qualified.

Every software would be examined, and you will eligible projects will be assigned to a wait number dependent on the impact so you’re able to safe practices, early in the day utilization of the program, and alignment together with other program goals. Immediately following a qualified project are at the top of the waiting record, teams tend to get in touch with applicants to request more files to help you establish qualifications and initiate your panels. Most other qualifications considerations incorporate and you will be assessed since strategies was vetted for final acceptance.

- Home Repair Program

- Rental Treatment Loan System

- Historic Financing Program

Household Fix Program

- Balance property owners within first tool out-of quarters, helping on aim of retaining affordable homeownership.

- Help crucial solutions getting present affordable construction devices to steadfastly keep up and keep maintaining they since the sensible casing stock inside the City.

Our home Repair program provides up to $twenty-five,000 inside recommendations to possess ideas that assist which have health, safeguards, and you may precautionary fix requires.

- First Repairs allow for around $5,000 from inside the direction for crucial domestic solutions, like liquids provider and you will sewer range updates, heating system and you can water heater replacements or any other key improvements.

- Complete Solutions will assist people having numerous or advanced ideas, or systems you to definitely go beyond $5,000 during the difficult will set you back, around a maximum of $twenty five,000 each family. A lead chance comparison should be presented and you can acknowledged installment loans online California strategies need address any things understood, in addition to remediate open code violations. Home owners are required to provide a beneficial ten% meets for everyone fund more than $5,000.

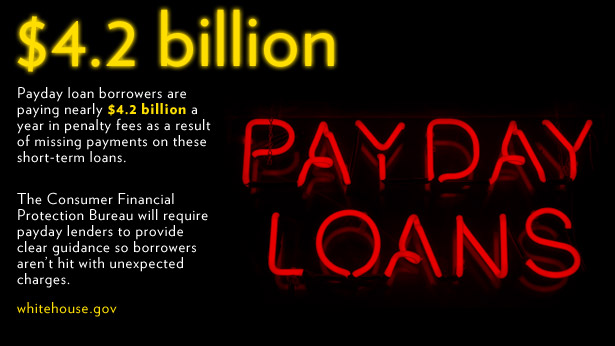

- Do it yourself Mortgage System funds can subsidize the speed for personal do-it-yourself financing giving around a great $5,000 offer to “purchase down” the interest rate so you can as low as 2 %.

- Lead-based paint guidelines apply to all the system possibilities.

Additional program standards and you may constraints implement. The fresh new City’s ability to assist with a task could be minimal by range, prices, loans available, lead or environment problems recognized, and other factors.

Rental Rehabilitation Mortgage System – Already Signed

Money could be agreed to best unhealthy conditions, build essential advancements, fix biggest options vulnerable to failure, deal with advancements related to energy savings, and boost entry to. Upon end, the whole construction build need conform to minimal homes password.

More funding, in the form of a zero-interest deferred fee financing, is agreed to address lead-oriented paint standards. It mortgage flow from and you can payable on the newest deals of one’s possessions or transfer away from control.

Applicant residents have to have enough security about possessions. Individuals have to have a credit score free of outstanding borrowing debt, late repayments, charge-offs, and you can mortgage default situations. The applicant’s credit rating have to be 640 or better, and the a home taxation repayments on the subject property have to getting newest.

Historic Financing System

From the Historic Financing System, low-notice payment fund are given to your conservation, repair, and you may rehab regarding usually and you may architecturally tall structures discover inside Town of Wichita.

To help you qualify, the house must be appointed and noted as a good landmark because of the your neighborhood, state, otherwise federal historic sign in, end up being an adding design inside a residential area, or perhaps be during the 1919 city constraints. Call the fresh new Urban Town Believe Institution for more information. Make sure to feel the particular property address readily available. The mortgage applicant also needs to become owner of the home otherwise must be getting the possessions into the a legitimate house purchases price.

More investment, in the way of a zero-desire deferred payment loan, is generally agreed to address lead-depending paint conditions. So it mortgage is born and payable abreast of the brand new income of property or import off ownership.

Tenants must not be displaced. Residents need invest in book finished products to prospects and you may/otherwise group that have revenue less than 80% of your area median money to own a period of 12 months. Monthly lease plus utilities may well not exceed 30% of occupant/occupant’s terrible month-to-month earnings, upon occupancy.