Want to Go through the Origination Procedure having a Charge card?

While the software is complete in addition to documentation registered, the procedure is today out of the borrower’s hand. The documents recorded and you can signed up until this aspect are recorded and tell you an automated underwriting program to-be accepted.

Specific data might be taken to an underwriter to have tips guide approval. The loan administrator upcoming has the appraisal, demands insurance coverage pointers, schedules an ending, and directs the borrowed funds document with the processor. Brand new chip get consult addiitional information, if required, getting examining the borrowed funds recognition.

Certain mortgage borrowers could be entitled to authorities-supported money, like those covered from the Government Homes Administration (FHA) or even the You.S. Department out-of Experienced Facts (VA). These types of funds are believed non-old-fashioned as they are arranged in a fashion that makes it much simpler to have eligible individuals to get homes. They often feature all the way down qualifying rates and an inferior or no down payment, while the origination processes can be a little smoother because of this.

Instance of Origination

Can you imagine a customer desires get its first home. It put in a deal into property and supplier welcomes. The 2 parties sign a binding agreement and commit to a buy cost of $2 hundred,000. The buyer has all in all, $50,000 saved up, which means they want to borrow $150,000 to cover the left harmony.

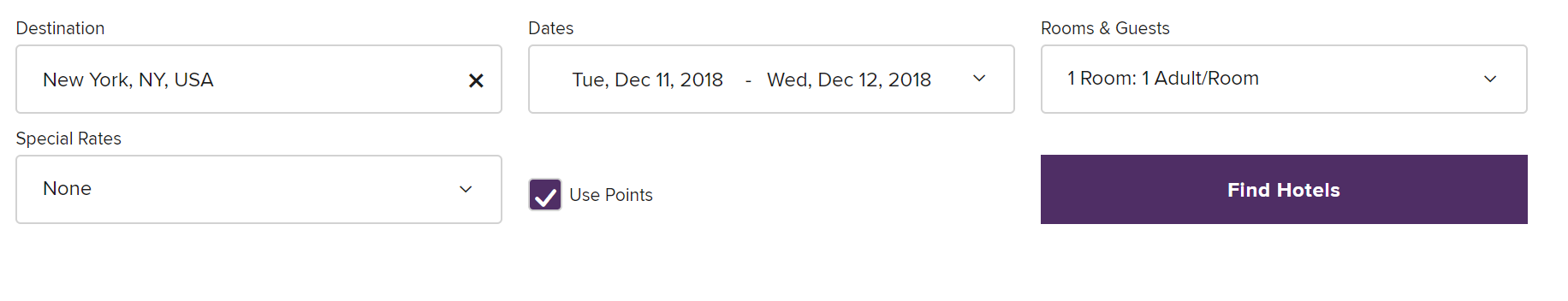

The buyer would go to their lender, ABC Lender, to find out if they pre-qualify. When they perform, ABC Bank requires them to complete a proper software and present supporting files, including its proof money, tax returns, lender comments, and you will acceptance having a credit assessment. The application and you will data files was delivered to this new underwriting institution of ABC Bank to evaluate perhaps the debtor are the ideal applicant towards mortgage.

Immediately after monthly, the financial institution approves the borrowed funds, connections the new borrower, and you may organizes a time for you signal the brand new papers. The fresh new debtor is informed of your interest and you may mortgage conditions and also have agrees to spend the loan origination percentage of just one% otherwise $step 1,five hundred. This will be subtracted on the financing balance (evoking the disbursement out-of $148,500), pay it upfront, otherwise have the seller spend they to them.

Why does financing Origination Really works?

Financing origination is the process loan providers used to determine and you will accept borrower software for various forms of debt. They have been money and you will loans Carbon Hill AL mortgages. Originations move from the initial app to possess borrowing from the bank due to underwriting and you will the fresh acceptance procedure. In order that the method to be hired, individuals must fill out an application and additional paperwork, including tax statements and pay stubs. Lenders usually cost you, that is a small percentage of equilibrium, to compensate all of them into the performs working in evaluating and you may approving the application.

Very financial institutions, creditors, and you will loan providers costs a keen origination payment for all the kind of financing once the a type of settlement on the financing procedure. This can include personal loans, debt consolidating money, mortgages, household guarantee funds, and others. Charge generally cover anything from 0.5% to a single% of your financing balance, and if you’re requesting good $100,000 financing, a 1% percentage might be $1,000. Some loan providers tends to be willing to negotiate the cost, in fact it is deducted about financing disbursement or paid back upfront. Understand that you pay the price when you’re approved.

The program and you may approval techniques getting a credit card isn’t as comprehensive since it is for a financial loan. Quite often, the origination out-of a credit card concerns filling in a software and getting a credit check complete, and you can become accepted in just several weeks to some months. Loan providers don’t fees a keen origination percentage having credit cards however they might need a security deposit if you’re just establishing the borrowing from the bank otherwise who has a less than perfect credit get.