What exactly is a keen assumable mortgage and just how can it work? Positives and negatives

What exactly is an assumable home loan?

An enthusiastic assumable mortgage is one which enables a different debtor in order to take over an existing financing on the latest debtor. Usually, which involves a home client overpowering the house https://paydayloanalabama.com/town-creek/ seller’s home loan.

The fresh borrower – the person assuming’ the mortgage – is in the same reputation due to the fact people passing it into the. Might have the same small print, a similar home loan rates, a similar left fees months, additionally the exact same home loan harmony.

Why does an assumable home loan works?

A keen assumable mortgage appears easy at the par value: You take more a preexisting financial out of other people as well as terms, interest, and you may amount borrowed stand a similar.

That means the monthly installments have an equivalent matter since the the initial debtor, incase you only pay the loan completely, possible find yourself repaying our home for a passing fancy time they could have.

In practice, even in the event, assumable mortgages is actually a little more state-of-the-art. They aren’t just a free of charge violation for somebody who has got having problems being qualified to possess a new mortgage.

- Not totally all types of mortgage loans is assumable. Old-fashioned financing cannot be presumed, including, however, FHA and you may Virtual assistant finance normally

- Not just anybody can guess a preexisting mortgage. You’ve still got to apply toward bank and you may be eligible for the loan

- You generally need to make a deposit when and in case a great home loan, and it can be larger than asked

Remember, after you suppose a home loan you take over the homeowner’s left financing harmony. Quite often that’ll not security the full purchase price regarding the home, thus it is possible to nevertheless you would like a down payment and make within the improvement.

From the correct state, there clearly was huge advantageous assets to using up an assumable mortgage. However, this plan would not benefit everyone, therefore it is important to understand the pros and cons prior to signing with the.

As to the reasons fool around with an assumable financial?

One of the greatest advantageous assets to these types of financial is that you may possibly secure a performance far beneath the most recent business, provided prices have increased as original loan was developed.

According to Freddie Mac, the fresh all the-date reasonable a week home loan rates occurred to the , whether or not it dipped in order to dos.65% to possess a 30-year repaired-price mortgage.

But, merely a few months afterwards, cost had increased more than step 3%. And several assume this type of costs so you can finest cuatro% or even more over time.

Today believe it’s many years later, and Freddie Mac’s per week average are cuatro.6% to own a 30-12 months home loan. When you’re considering an assumable mortgage on 2.6%, you’ll be across the moon.

Based on the home loan calculator (that can be used to design their condition), monthly prominent and you may focus money at the cuatro.65% is $step 1,025 towards the a $200,000 mortgage. However, that they had end up being $800 during the dos.6%.

That’s the big virtue assumable mortgage loans could offer. But couples problems will have aside like that it. So we also need to glance at the limitations and you may disadvantages out of assumable home loans.

Assumable home loan pros and cons

Demonstrably, an enthusiastic assumable home loan produces absolutely nothing sense whenever home loan costs is shedding. There’s absolutely no virtue for the taking over a current mortgage whenever their price is higher than one to you can purchase by making an effective the fresh new application.

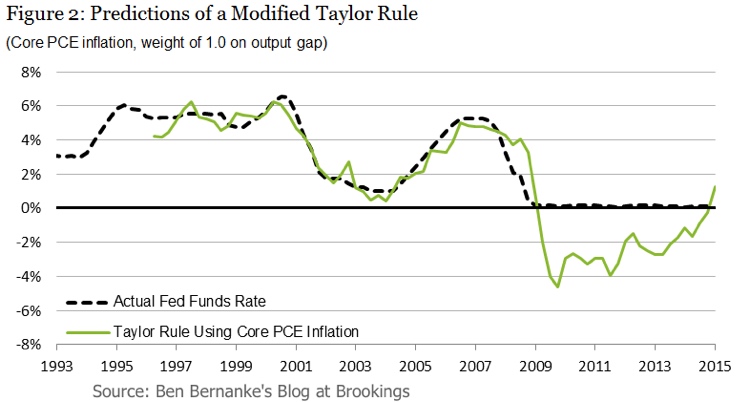

That’s why there was little focus on this option: not one person keeps wished an assumable loan for the years you to prices had been falling. However, costs are beginning so you’re able to swing straight back upward. So there is a go assumable mortgages you may look more glamorous during the the upcoming weeks and you will ages.

Assumable mortgage gurus

- Low interest – Just in case costs was ascending, you could potentially lock in an adult, straight down interest rate