Consumers having very poor, if you don’t bad credit, or too much obligations, refinancing would be risky

In this situation, the original loan was reduced, enabling the second loan become composed, as opposed to merely and work out a unique home loan and you can throwing out the fresh new amazing financial.

Getting borrowers with the greatest credit history, refinancing are going to be a sensible way to transfer a variable loan speed in order to a predetermined, and get a diminished rate of interest.

Often, since anybody sort out the work and you will always create more currency they could pay all its expense punctually which means that increase their credit score.

With this specific escalation in credit happens the capacity to procure funds within down costs, and therefore a lot of people refinance along with their finance companies for this reason.

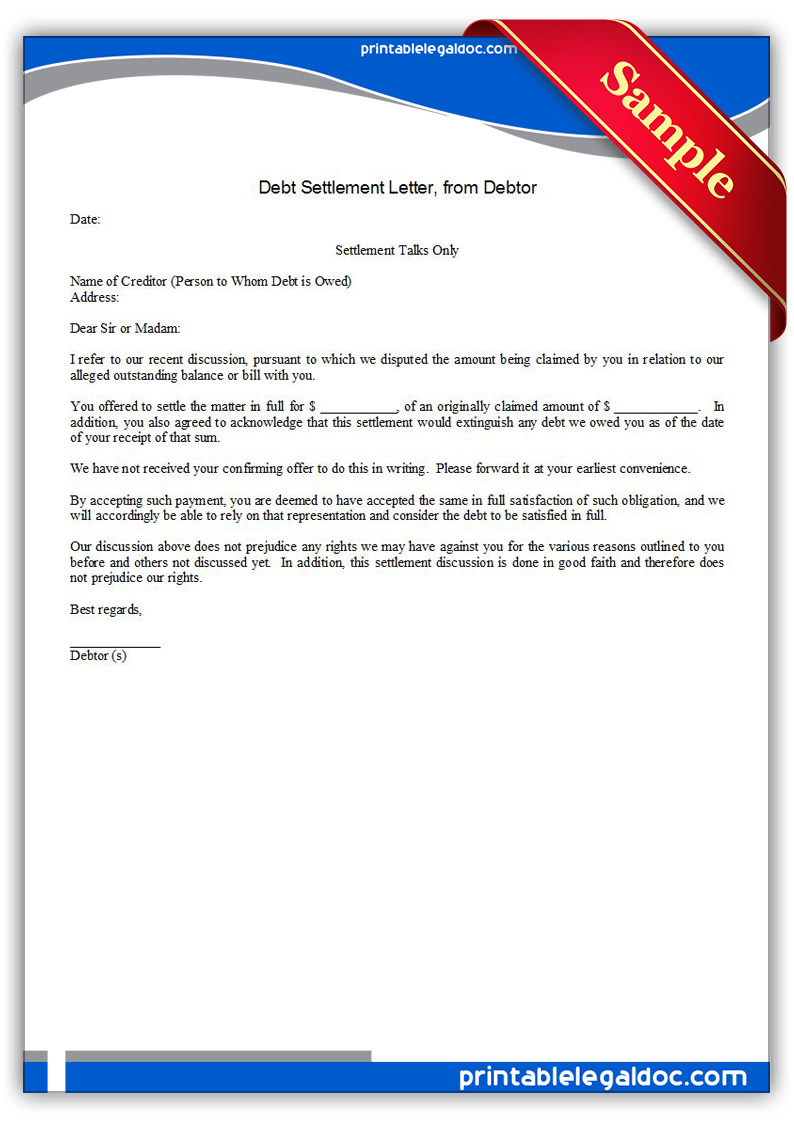

Pre-pick will set you back out-of a house pick thanks to financial is also full right up to 30 per cent of your property’s value Image Credit: Shutterstock

A lower rate of interest have a deep affect month-to-month money, probably helping you save numerous dirhams a year.

A lowered interest can have a serious effect on month-to-month money, potentially helping you save numerous dirhams a year.

Without the right education, however, it can indeed harm you to definitely re-finance, boosting your interest unlike decreasing it.

Cash-out household security: Homeowners is also extract guarantee on the belongings. In the event the collateral are removed to fund domestic repairs otherwise big renovations the eye expense could be tax-deductible.

Transform financing period: Shorten stage to spend faster desire across the longevity of the loan and you can very own the house outright shorter; lengthen the brand new cycle to reduce monthly obligations.

Is NRIs get it business?

NRIs can also be refinance their loans-totally free services inside the India. Indeed, the process getting availing financing against a property doesn’t differ much to have an NRI and you may a citizen of India.

So long as an enthusiastic NRI has a domestic or commercial property in the otherwise their unique identity, that individual can certainly borrow against his property.

The method having choosing that loan up against a property cannot will vary much to have an enthusiastic NRI and you can a resident of Asia.

However, you will find several restrictions to how much cash are transmitted, availed or borrowed, and then have perquisites concerning minimal earnings http://www.paydayloansconnecticut.com/lordship specifications.

Restrictions when borrowing facing financial obligation-free assets during the Asia

Fund can only just getting based on a maximum of a couple attributes, which are susceptible to fees. There is also a limitation into matter that may be transported, which is up to $250,000-a-individual (Dh918,262) annually.

The minimum it’s possible to borrow on one possessions oftentimes, regardless if you are an enthusiastic NRI or otherwise not, is INR 500,000 (Dh 24,292), as maximum is INR fifty million (Dh2.cuatro million).

The loan count can move up to INR 100 mil (Dh4.nine billion), based your own repayment capabilities, and the area where in fact the mortgage is disbursed.

Funds can simply end up being based on a maximum of a couple of features, which happen to be susceptible to taxes.

Really lenders typically provide finance between sixty-70 per cent of the market price in your home (loan-to-really worth ratio) that will be readily available merely normally in order to salaried NRIs.

However some lenders manage avail 80 per cent LTV, there may be others that provide simply forty-50 per cent LTV of the homes, that is susceptible to your revenue qualifications.

LTV proportion was higher having money pulled up against residential property, while you are LTV ratio is low to possess mortgage up against industrial property.

LTV and relies on occupancy. Considering research of Deal4loans, normally, the fresh LTV ratio to own home that’s mind-filled, is actually 65 % of their market price.